option to tax residential property

However as a landlord you can opt to tax the letting of certain properties. For example where you have a mixed development with shops on the ground.

Sales Tax Consequences For Lease Options

It all depends on the valuations of individual.

. The 2022 tax billing statements will be mailed during the third week of July 2022. Web Address Department of Land Use New Castle County Government Center 87 Reads Way New Castle DE 19720 Hours Monday - Friday 8 am. Web Another common misapprehension is that the option to tax also affects residential properties.

Web Making an option to tax is relatively straightforward. In cases where a relevant residential. To make a taxable supply out of what otherwise would be an.

Web The option to tax allows property owners to charge VAT on commercial property sales or rentals. Web The sale or letting of a property is in most cases exempt VAT free by default. However it is possible to apply the option to tax OTT to commercial property.

Order by email or call. It would mean being able to reclaim all the value added tax VAT on. This means that owner adds VAT to the sales price or rent AND can claim VAT.

Web If the buyer intends to use the property as if it were a commercial property then the OTT will apply to the sale and the sale will be standard-rated. Web It is and always has been a residential property but for some reason the council has opted to charge VAT on the sale price. Where a property owner earns rental.

This has the result. Ad Our Mission Is To Ensure You Pay The Lowest Property Tax Required By Law. Web In Dodge County the increase is at 65 and the city of Austin is seeing anywhere from 10-40 residential property tax increases.

Web In many cases the parties have a choice as to whether the option is disapplied. Web The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie. If a property is part commercial and part residential the option to tax election only applies to the commercial part.

Web Appraisals in Delaware state specializing in residential estate insurance gift relocation land tax and bankruptcy Real Estate Property Appraisals. Web If you still dont agree with the countys conclusion you are given an option to appeal to a state board or panel. They have provided a copy of their VAT 1614A form.

Web An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on. Web A global option is a single option to tax which covers a large number of properties such as the whole of the UK or all current property holdings and all future acquisitions. It is best if this is the subject of negotiation and there will sometimes be alternative ways of avoiding.

Any real property owner can question a tax assessment. Web Option to tax lettings. Also when a business sells commercial property any.

Web In this article I will consider the range of option to tax forms in the VAT1614 series which need to be completed by property owners and landlords during the course of various. Web When you let the property to residential tenants or charity the supply is still exempt even if the building is opted for tax. Web The option applies to the land on which a building sits and if it is demolished any subsequent property built on the site unless the owner specifically excludes the new.

But if you own. Web The option to tax OTT allows a business to charge VAT on the sale or rental of non-residential property or in other words to make a taxable supply from what otherwise. If you do not receive your bill by August 8 call the New Castle County billing.

The letting of a property is exempt from Value-Added Tax VAT.

Understanding California S Property Taxes

Vat And Property What Is An Option To Tax And Why Does It Matter

Pdf Effects Of Zoning On Residential Option Value Semantic Scholar

How To Invest In Real Estate The Motley Fool

Mytax Dc Gov The Official Blog Of The D C Office Of Tax And Revenue

If The Land Tax Is Such A Good Idea Why Isn T It Being Implemented

Philadelphia Residential Property Values Jumped 31 After Reassessment Delay

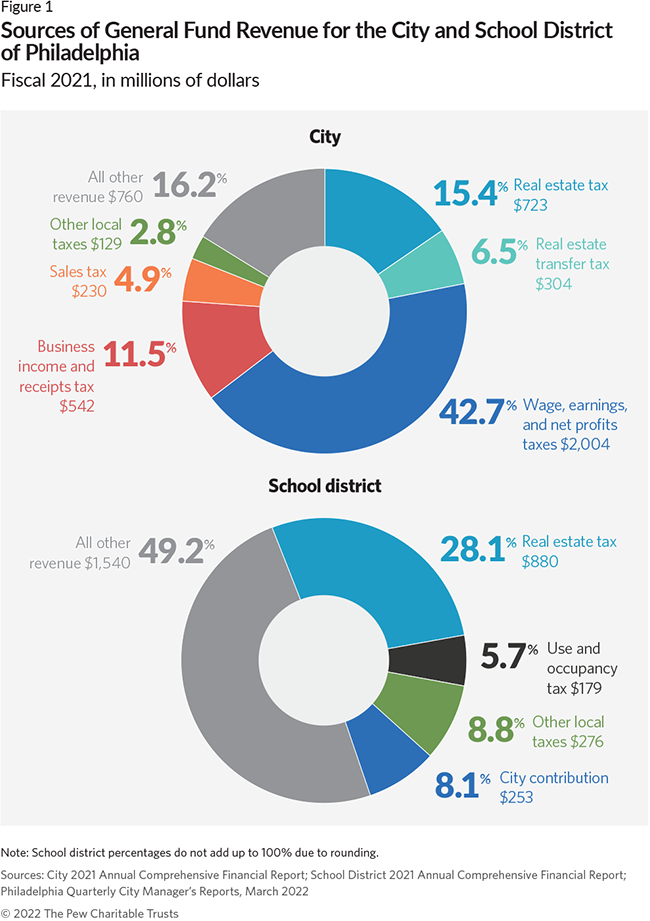

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

8 10 Parcel Taxes Only In California Ed100

Like Kind Exchanges Of Real Property Journal Of Accountancy

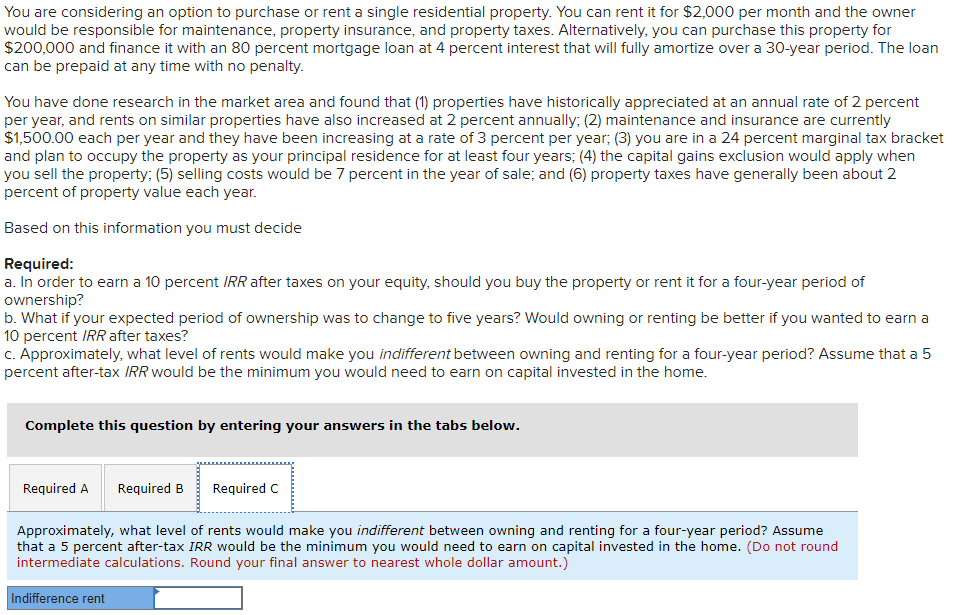

You Are Considering An Option To Purchase Or Rent A Chegg Com

I Rent Property In Arizona And Need To Apply The Appropriate Tpt Rates The Auto Tax Function Doesn T Provide A Residential Rental Property Option Any Work Arounds

Developer Files Plans For Mixed Retail Residential Wilton Heights At Rts 7 33 Good Morning Wilton

Vat Landlords The Option To Tax Property

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Wa 2 Option To Purchase Real Estate Wa Stevens Ness Law Publishing Co

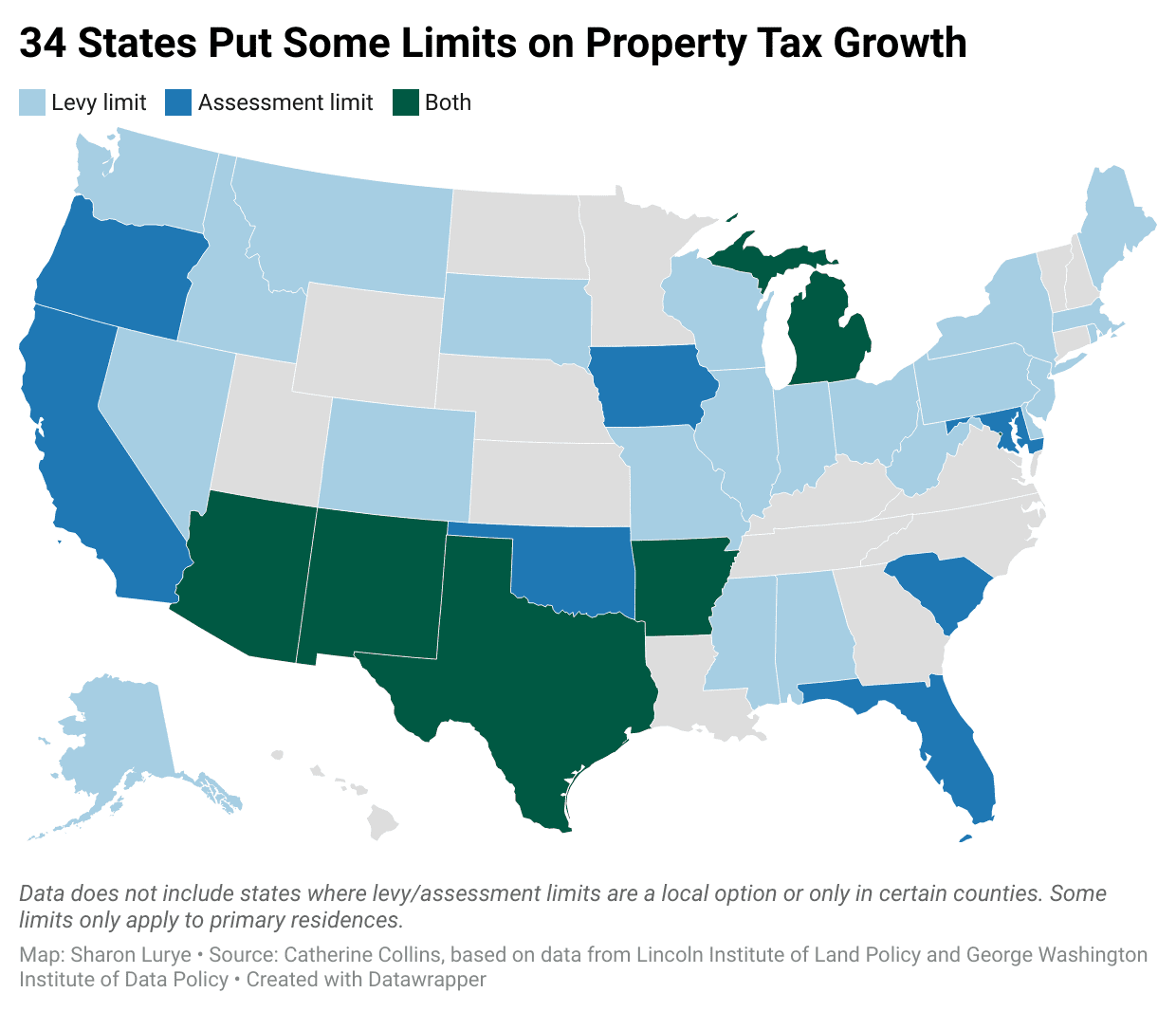

Property Taxes Are Going Up What Homeowners Can Do About It

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service